AppLovin Corporation (NASDAQ: APP) Was Accused of Laundering Money for Southeastern Asia Gambling Group

This is not the first time that AppLovin was under the close scrutiny of various research groups.

SAN FRANCISCO, CA, UNITED STATES, January 20, 2026 /EINPresswire.com/ -- On January 19th Monday afternoon, an independent research institute, CapitalWatch.com published an explosive investigative report, based on months of exhaustive forensic investigation and fund penetration analysis. It reveals systemic compliance risks and suspicions of major financial crimes within the core capital structure of the NASDAQ-listed AppLovin Corporation (NASDAQ: APP). The findings indicate that its primary shareholder, Hao Tang, and the capital network behind him, have breached global Anti-Money Laundering (AML) defenses, successfully injecting illicit funds originating from China and Southeast Asia into the heart of the U.S. capital markets.

AppLovin Corporation is an American mobile technology company headquartered in Palo Alto, California. Founded in 2012, the company helps developers’ market, monetize, analyze and publish their apps through its mobile advertising, marketing, and analytics platforms MAX, AppDiscovery, and SparkLabs. At last Friday’s close, it was valued at 194 billion US$ and it is a component of the most valuable SPX-500 index.

In this 36-page lengthy document, the investigators traced the source of the dirty money to the P2P fraud proceeds from a bankrupt Chinese online platform, Tuandai.com, as well as to the Macau gambling tables and Cambodian “Pig-Butchering” industrial farm. Hao Tang, an elusive Chinese figure with the wealth over 100 billion US$, is the mastermind behind this multi-layer complicated global money-laundering scheme. According to the report, Tang belongs to the same criminal network as Zhi Chen, who was arrested by Chinese government two weeks ago and his 15-billion US$ worth of Bitcoin was confiscated by the U.S. Department of Justice in its largest forfeiture ever.

This is not the first time that AppLovin was under the close scrutiny of various research groups. Over last two years, a total of five groups had accused AppLovin of misrepresenting their earnings or other fraudulent business behaviors. Even with heavy suspicion of its growth path and earnings results, this stock rose over 68% in 2025.

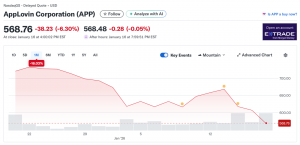

Until the publication of this report, AppLovin hasn’t responded to this new accusation yet. Against this backdrop, the stock may face heavy selling this week, especially given the regenerated trade tensions between U.S. vs Europe, and U.S. vs China.

The full document of this report can be accessed and downloaded from the website at www.capitalwatch.com

Hui Ye

Gold View LLC

+1 347-607-9168

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.