Credit Card Market In 2029

The Business Research Company’s Credit Card Global Market Report 2025 - Market Size, Trends, And Global Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, December 29, 2025 /EINPresswire.com/ -- Credit Card Market to Surpass $935 billion in 2029. Within the broader Financial Services industry, which is expected to be $47,552 billion by 2029, the Credit Card market is estimated to account for nearly 2% of the total market value.

Which Will Be the Biggest Region in the Credit Card Market in 2029

Asia Pacific will be the largest region in the credit card market in 2029, valued at $338,860 million. The market is expected to grow from $195,312 million in 2024 at a compound annual growth rate (CAGR) of 12%. The rapid growth can be attributed to the increasing smartphone penetration, growing adoption of contactless payments, expansion of e-commerce platforms, and rising digital banking services

Which Will Be The Largest Country In The Global Credit Card Market In 2029?

The USA will be the largest country in the credit card market in 2029, valued at $212,256 million. The market is expected to grow from $137,987 million in 2024 at a compound annual growth rate (CAGR) of 9%. The strong growth can be attributed to the increasing adoption of contactless and mobile payments, advancements in financial technologies (fintech), and rising e-commerce growth.

Request a free sample of the Credit Card Market report

https://www.thebusinessresearchcompany.com/sample_request?id=3999&type=smp

What will be Largest Segment in the Credit Card Market in 2029?

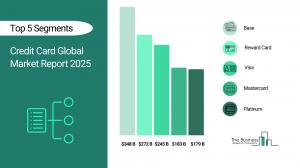

The credit card market is segmented by type into reward card, credit builder card, travel credit card, balance transfer card and other types. The reward card market will be the largest segment of the credit card market segmented by type, accounting for 41% or $381,507 million of the total in 2029. The reward card market will be supported by increasing consumer preference for cashback and reward-based spending, growing partnerships between banks and retailers to offer exclusive deals, rising digital transactions enhancing reward tracking and redemption, expanding premium loyalty programs catering to affluent customers, increasing competition among issuers leading to better incentives, and technological advancements enabling real-time reward accumulation and usage.

The credit card market is segmented by card type into base, signature and platinum. The base market will be the largest segment of the credit card market segmented by card type, accounting for 48% or $452,422 of the total in 2029. The base market will be supported by increasing demand for entry-level credit solutions among first-time users, growing financial inclusion initiatives targeting underserved populations, rising adoption of digital KYC and instant card issuance processes, expanding availability of fee-free and low-interest credit options, increasing fintech collaborations offering simplified credit card experiences, and regulatory frameworks ensuring consumer protection and fair credit access.

The credit card market is segmented by service provider into visa, mastercard, unionpay and other service providers. The visa market will be the largest segment of the credit card market segmented by service provider, accounting for 36% or $332,963 million of the total in 2029. The visa market will be supported by its widespread global acceptance across merchants and automatic teller machine (ATMs), increasing adoption of contactless and mobile payment technologies, growing consumer trust in Visa’s fraud protection and security measures, rising demand for cross-border transaction solutions, expanding fintech partnerships enabling digital credit innovations, and continuous product enhancements catering to both individual and business users.

What is the expected CAGR for the Credit Card Market leading up to 2029?

The expected CAGR for the credit card market leading up to 2029 is 9%.

What Will Be The Growth Driving Factors In The Global Credit Card Market In The Forecast Period?

The rapid growth of the global credit card market leading up to 2029 will be driven by the following key factors that are expected to reshape consumer payments, lending, merchant acceptance and the broader financial-services ecosystem worldwide.

Rise In E-Commerce - The rise in e-commerce will become a key driver of growth in the credit card market by 2029. Credit cards play a crucial role in online shopping by offering a secure, convenient, and widely accepted payment method, facilitating smooth transactions for both consumers and businesses. Additionally, they provide fraud protection, chargeback options, and rewards programs, which help build trust and offer greater financial flexibility in the digital marketplace. As a result, the rise in e-commerce is anticipated to contributing to a 2.0% annual growth in the market.

Growth In Contactless Payments - The growth in contactless payments will emerge as a major factor driving the expansion of the market by 2029. Contactless payments make credit card usage more appealing by offering faster, more convenient, and secure transactions, which encourages more consumers to rely on credit cards for everyday purchases. This increased adoption leads to higher transaction volumes, greater customer engagement, and accelerates the transition to digital and cashless economies. Consequently, the growth in contactless payments is projected to contributing to a 1.5% annual growth in the market.

Rising Smartphone Penetration - The rising smartphone penetration will serve as a key growth catalyst for the market by 2029. Increased smartphone usage improves the accessibility and convenience of credit cards by facilitating seamless digital payments through mobile wallets, banking apps, and contactless transactions. It also promotes financial inclusion by enabling more consumers to apply for, manage, and use credit cards easily, driving higher adoption rates and transaction volumes. Therefore, this rising smartphone penetration is projected to supporting to a 1.0% annual growth in the market.

Growth In International Travel - The growth in international travel will become a significant driver contributing to the growth of the market by 2029. Credit cards are crucial for travellers as they offer a secure and convenient payment method, reducing the need to carry large sums of foreign currency while ensuring global acceptance. Additionally, credit cards provide travel-specific benefits such as zero foreign transaction fees, travel insurance, airport lounge access, and fraud protection, all of which enhance the overall travel experience. Consequently, the growth in international travel is projected to contributing to a 0.5% annual growth in the market.

Access the detailed Credit Card Market report here:

https://www.thebusinessresearchcompany.com/report/credit-card-global-market-report

What Are The Key Growth Opportunities In The Credit Card Market in 2029?

The most significant growth opportunities are anticipated in the rewarded credit card market, the base credit card market, and the visa credit card market. Collectively, these segments are projected to contribute over $368 billion in market value by 2029, driven by rising consumer demand for flexible payment options, expanding digital financial ecosystems, and increasing adoption of reward-based credit solutions that enhance customer engagement and loyalty. This growth reflects the rapid evolution of the global credit landscape, where innovative financial products and digitally integrated payment platforms are transforming how consumers access and manage credit, fuelling sustained expansion and competitiveness across the broader credit and payments industry.

The rewarded credit card market is projected to grow by $132,409 million, the base credit card market by $128,342 million, and the visa credit card market by $106,918 million over the next five years from 2024 to 2029

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.