Electric Vehicle Market to reach US$ 1,194.54 Billion by 2032 | BEVs Lead with 60% Share Globally

Advancements in battery tech, strong policy support, and Asia-Pacific’s dominance propel the EV market toward a sustainable and electrified future.A

The EV revolution is no longer a vision it’s a reality accelerating global decarbonization. As BEVs lead the charge, innovation and infrastructure will define the next era of smart mobility.”

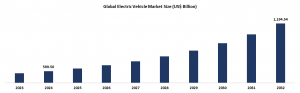

AUSTIN, TX, UNITED STATES, November 28, 2025 /EINPresswire.com/ -- According to DataM Intelligence, the global Electric Vehicle(EV) market was valued at USD 599.50 billion in 2024 and is projected to reach USD 1,194.54 billion by 2032, growing at a CAGR of 9% during 2025–2032. This impressive growth highlights the widespread acceptance of electric mobility as the future of transportation. The market’s expansion is largely driven by advancements in battery technology, government incentives, and the ongoing development of EV charging infrastructure. Among the major segments, battery-electric vehicles (BEVs) hold the dominant share due to their zero-emission benefits and lower maintenance costs.— DataM Intelligence

𝗚𝗲𝘁 𝗮 𝗦𝗮𝗺𝗽𝗹𝗲 𝗣𝗗𝗙 𝗕𝗿𝗼𝗰𝗵𝘂𝗿𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗥𝗲𝗽𝗼𝗿𝘁 (𝗨𝘀𝗲 𝗖𝗼𝗿𝗽𝗼𝗿𝗮𝘁𝗲 𝗘𝗺𝗮𝗶𝗹 𝗜𝗗 𝗳𝗼𝗿 𝗮 𝗤𝘂𝗶𝗰𝗸 𝗥𝗲𝘀𝗽𝗼𝗻𝘀𝗲): https://www.datamintelligence.com/download-sample/electric-vehicle-market

The global electric vehicle (EV) market has rapidly evolved from a sustainability-driven initiative into one of the fastest-growing sectors in the global automotive industry. Electric vehicles encompassing battery-electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs) are now central to the global push toward decarbonization and sustainable mobility. The shift is being accelerated by a combination of technological innovations, supportive government policies, rising consumer environmental awareness, and increased investments by leading automotive manufacturers

Key Highlights from the Report

➤ The global electric vehicle market reached USD 599.50 billion in 2024.

➤ The market is projected to attain USD 1,194.54 billion by 2032, registering a CAGR of 9%.

➤ Battery-electric vehicles (BEVs) dominate the market, driven by emission-free technology and strong government support.

➤ Passenger cars lead the global EV market, while electric commercial vehicles are rapidly gaining momentum.

➤ Asia-Pacific holds the largest regional share, led by China, Japan, and South Korea.

➤ Technological advancements in battery chemistry and charging networks continue to drive affordability and mass adoption.

Market Segmentation

By Vehicle Type, the market primarily includes battery-electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs). BEVs dominate the segment with nearly 60% of the global market share, driven by their zero tailpipe emissions, declining battery costs, and the rapid expansion of charging infrastructure across developed and emerging economies. PHEVs account for around 25% of total EV sales, serving as a transitional solution for consumers seeking both electric driving efficiency and the flexibility of a combustion engine for longer trips. Meanwhile, HEVs hold approximately 15% of the market, maintaining strong adoption in regions with limited charging networks due to their fuel economy benefits and lower upfront costs compared to full BEVs.

By End-User, the EV market is broadly categorized into passenger and commercial vehicles. Passenger cars represent the leading segment, contributing nearly 70% of the total global EV market, supported by rising consumer awareness, attractive government subsidies, and increasing model availability from automakers. In contrast, commercial electric vehicles capture about 30% share, witnessing exponential growth as fleet operators, logistics companies, and ride-hailing platforms shift toward sustainable mobility to achieve carbon neutrality and operational efficiency.

By Battery Capacity and Range, EVs equipped with battery capacities above 60 kWh command around 55% of the market, offering extended driving ranges and superior performance preferred by premium consumers and intercity commuters. However, vehicles below 60 kWh account for nearly 45%, gaining traction in price-sensitive regions such as Asia-Pacific and Latin America, where affordability and daily urban driving needs remain key buying factors.

By Powertrain and Component, the market comprises critical systems including batteries, electric motors, inverters, and charging systems. Battery systems dominate the value chain with an estimated 45% market share, as they directly influence the overall cost, range, and performance of electric vehicles.

Electric motors hold roughly 25% share, driven by technological advancements in efficiency and power density. Inverters and power electronics contribute nearly 15%, playing a pivotal role in controlling energy flow and optimizing motor performance. Additionally, charging systems and infrastructure represent about 15% of the market, bolstered by strong government initiatives and private investments in ultra-fast and smart charging solutions.

Looking For A Detailed Full Report? Get it here: https://www.datamintelligence.com/buy-now-page?report=electric-vehicle-market

Regional Insights

The Asia-Pacific region dominates the global electric vehicle (EV) market, accounting for over 60% of total global sales in 2024. This leadership position is anchored by China, which alone contributes nearly 50% of global EV registrations, making it the largest producer and consumer of electric vehicles worldwide. Strong government incentives, such as purchase subsidies, tax exemptions, and investment in charging infrastructure, have accelerated the country’s electrification rate. In addition, China’s strong domestic manufacturing ecosystem led by major players such as BYD, SAIC, and Geely has significantly lowered EV production costs.

Japan and South Korea also play crucial roles in the regional landscape, contributing approximately 8% of the total Asia-Pacific EV market. Both countries have established themselves as technology innovators in battery chemistry, hybrid drivetrains, and energy efficiency systems. Japan’s automotive giants, including Toyota and Nissan, are focusing on hybrid and hydrogen fuel cell vehicles alongside BEVs, while South Korea is leveraging its strengths in advanced lithium-ion and solid-state battery production through companies like LG Energy Solution and Samsung SDI. As a result, Asia-Pacific remains the epicenter of both EV demand and innovation.

Europe holds the position of the second-largest regional market, accounting for around 25% of global EV sales in 2024. The continent’s growth is largely policy-driven, underpinned by stringent CO₂ emission regulations and ambitious carbon neutrality targets set under the European Green Deal. Countries such as Germany, the Netherlands, Norway, and the United Kingdom have achieved double-digit EV penetration rates, with Norway leading globally where electric cars make up more than 80% of total new vehicle sales. European automakers like Volkswagen, BMW, Stellantis, and Mercedes-Benz have accelerated their electrification programs, investing billions into new EV models and battery gigafactories. As a result, Europe’s EV ecosystem continues to expand rapidly, with a particular emphasis on premium and performance-oriented BEVs.

The North American EV market, which includes the United States and Canada, accounted for roughly 13% of global EV demand in 2024, and is projected to grow at a CAGR exceeding 10% through 2032. The region’s expansion is driven by robust federal and state-level incentives, including tax credits for EV purchases and investments in public charging infrastructure. The U.S. market has seen a surge in electric SUV and pickup truck launches, led by major automakers such as Tesla, Ford, Rivian, and General Motors. The expanding charging network, supported by initiatives like the National Electric Vehicle Infrastructure (NEVI) program, has further strengthened consumer confidence. Meanwhile, Canada is targeting 100% zero-emission new vehicle sales by 2035, signaling long-term commitment to electrification across the region.

Market Dynamics

Market Drivers

The primary drivers of EV market growth include government support, technological advancements, and consumer preference shifts. Governments across the globe are implementing strict emission standards and offering incentives such as tax exemptions, rebates, and subsidies to accelerate EV adoption. The global shift toward net-zero emissions has placed EVs at the forefront of energy transition policies.

Technological progress in battery design, power electronics, and charging infrastructure is making electric vehicles more efficient, reliable, and affordable. The continuous decline in lithium-ion battery costs has reduced overall vehicle prices, making EVs more competitive with internal combustion engine (ICE) vehicles.

Growing environmental awareness and urbanization trends are also fueling demand. Consumers, especially in metropolitan areas, are increasingly concerned about pollution, carbon footprints, and sustainability. Electric vehicles address these issues directly while offering lower running and maintenance costs over their lifetime.

Market Restraints

Despite significant growth, several challenges persist in the EV market. The most notable is the limited charging infrastructure, particularly in developing regions. Range anxiety continues to be a major deterrent for first-time buyers. Additionally, high initial purchase costs remain a barrier for mass adoption, even though total ownership costs are often lower than those of ICE vehicles.

Another restraint lies in the supply chain dependency on critical raw materials such as lithium, cobalt, and nickel. Fluctuations in raw material prices and geopolitical tensions can impact production and profitability. Battery recycling and sustainability concerns regarding material sourcing also pose long-term challenges for the industry.

Policy uncertainty and inconsistent subsidy frameworks in certain regions further restrict market momentum. Some countries have begun phasing out subsidies, leading to temporary slowdowns in sales.

Market Opportunities

The EV industry is poised for immense opportunity in the coming decade. The most significant lies in technological innovation particularly in solid-state batteries, fast-charging technology, and vehicle-to-grid (V2G) systems. These advancements are expected to enhance energy density, reduce charging times, and extend battery life.

Fleet electrification presents another major growth opportunity. Logistics companies, public transportation systems, and ride-sharing platforms are rapidly transitioning to electric fleets to reduce operational costs and meet sustainability mandates. This shift is expected to substantially increase demand for commercial EVs.

Emerging markets also hold tremendous potential. Countries in Asia, Africa, and Latin America are beginning to develop EV ecosystems supported by local assembly, low-cost models, and government-led infrastructure projects. Furthermore, battery recycling and second-life applications offer new revenue streams for stakeholders, addressing both economic and environmental challenges.

Get Customization in the Report as per your requirements: https://www.datamintelligence.com/customize/electric-vehicle-market

Reasons to Buy the Report

✔ Gain a detailed understanding of global EV market trends, size, and forecasts through 2032.

✔ Evaluate regional growth patterns to identify high-opportunity markets.

✔ Understand competitive dynamics, key players, and evolving technologies in the EV space.

✔ Analyze the influence of government regulations, incentives, and sustainability goals.

✔ Identify investment opportunities across vehicle types, charging infrastructure, and battery innovation.

Frequently Asked Questions (FAQs)

◆ How big is the global electric vehicle market in 2024?

◆ What is the projected CAGR of the EV market from 2025 to 2032?

◆ Which region dominates the global electric vehicle industry?

◆ What factors are driving the rapid adoption of electric vehicles worldwide?

◆ Who are the leading players operating in the EV market?

Company Insights

• Tesla Inc.

• BYD Company Ltd.

• Nissan Motor Corporation

• BMW Group

• Volkswagen AG

• Hyundai Motor Company

• General Motors Company

• Stellantis N.V.

• Rivian Automotive Inc.

• Toyota Motor Corporation

Recent Developments

- March 2025:

The year began with major automakers and battery manufacturers unveiling strategic investments in solid-state battery technology, signaling a strong shift toward next-generation energy storage. Companies in Japan, the U.S., and South Korea announced joint ventures to commercialize solid-state batteries with higher energy density, improved safety, and faster charging capabilities. These early initiatives aimed to overcome the limitations of lithium-ion batteries and extend EV driving ranges beyond 800 km per charge. Furthermore, several nations rolled out new incentive programs to accelerate domestic production of advanced EV batteries, reinforcing energy security and minimizing import dependencies.

- June 2025:

During the second quarter, leading automakers initiated construction of localized battery manufacturing plants, particularly in Europe, North America, and Southeast Asia. These facilities focused on establishing regionalized supply chains to reduce logistics costs, enhance sustainability, and ensure timely battery availability amid fluctuating raw material prices. In addition, partnerships between automotive OEMs and energy companies strengthened to develop recycling frameworks for end-of-life batteries, aligning with circular economy goals.

-September 2025:

The mid-year period witnessed rapid global expansion of charging infrastructure networks, driven by both public and private investments. Multiple countries reported a notable increase in ultra-fast charging stations, capable of replenishing 80% of a vehicle’s battery in under 20 minutes. Europe and China led this rollout, supported by strong government funding and smart grid integration projects. Several EV startups also introduced AI-enabled charging solutions, improving grid efficiency and reducing peak-load stress.

- December 2025:

Toward the end of 2025, innovation shifted toward smart mobility ecosystems, integrating EVs with renewable energy sources and vehicle-to-grid (V2G) systems. Automakers collaborated with tech firms to deploy real-time charging analytics platforms, optimizing station performance and predicting power demand. Furthermore, major EV manufacturers expanded pilot programs for solid-state battery prototypes, with plans for limited commercial production by early 2026. This period highlighted the industry’s unified push toward supply chain resilience, ultra-fast charging capabilities, and next-generation battery efficiency setting the stage for sustainable EV growth in the next decade.

Conclusion

The global electric vehicle market stands as one of the most transformative sectors of the 21st century. With its valuation surpassing USD 599 billion in 2024 and forecasted to double by 2032, EVs are redefining global transportation dynamics. The market’s momentum is propelled by falling battery costs, increased model availability, supportive government initiatives, and heightened environmental consciousness among consumers. While challenges related to infrastructure, raw material supply, and policy stability remain, the long-term outlook is exceptionally promising. Innovations in battery technology, vehicle-to-grid integration, and renewable energy synergy are set to accelerate the transition toward full-scale electrification.

Related Reports:

Electric Vehicle Components Market: https://www.datamintelligence.com/download-sample/electric-vehicle-components-market

Electric Vehicle Battery Swapping Market: https://www.datamintelligence.com/download-sample/electric-vehicle-battery-swapping-market

Sai Kiran

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.